irrevocable trust capital gains tax rate 2020

At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed with the Affordable Care Act. What is the capital gains tax rate for trusts in 2020.

The Generation Skipping Transfer Tax A Quick Guide

Irrevocable trusts pay tax at the top tax bracket.

. The maximum tax rate for long-term capital gains and qualified dividends is 20. The maximum tax rate for long-term capital gains and qualified dividends is 20. 21 2018 Deferred Tax Liability.

2022 Long-Term Capital Gains Trust Tax Rates. What is the capital gains tax rate for trusts in 2020. The maximum tax rate for long-term capital gains and qualified dividends is 20.

The tax rates for trusts are extremely compressed. However long term capital gain generated by a trust still. For tax year 2020 the 20 rate applies to amounts above.

9 How is irrevocable trust income taxed. Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and. The trustees take the losses away from the gains leaving no chargeable gains for the.

For tax year 2020 the 20 rate applies to amounts above 13150. For tax year 2020 the 20 rate applies to amounts above. Trust tax rates are very high as you can see here.

The 15 rate applies to. For the 2020 tax year the first 2650 of capital gains earned by trusts are not taxed and there is a 15 tax rate for gains above this amount up to 13150. The maximum tax rate for long-term capital gains and qualified dividends is 20.

For example the top ordinary Federal. What is the capital gains tax rate for trusts in 2020. The 0 rate applies up to 2650.

Capital gains however are not considered to be income to irrevocable trusts. The maximum tax rate for long-term capital gains and qualified dividends is 20. X Maximum capital gains tax rate.

For tax year 2020 the 20 maximum capital gain rate applies to estates and trusts with income above 13150. You can find your adjusted gross income on line 11. For tax year 2020 the 20 maximum capital gain rate applies to estates and trusts with income above 13150.

Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income. Capital gains taxes are usually lower than earned income taxes. An irrevocable trust needs to get a tax ID EIN number and pay taxes each year by filing a 1041 tax return.

Capital gains and qualified dividends. The maximum tax rate for long-term capital gains and qualified dividends is 20. Instead capital gains are viewed as contributions to the principal.

Two prepayments of tax for 202021 will also be required one on 31 January 2021 and the other on 31 July 2021. In 2020 to 2021 a trust has capital gains of 12000 and allowable losses of 15000. The 0 rate applies up to 2650.

The 15 rate applies to. Consequently if the trust. Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000.

For tax year 2020 the 20 rate applies to amounts above. If the trust has capital losses in excess of capital gains for any tax year. For tax year 2022 the 20 rate applies to amounts above 13700.

What is the capital gains tax rate for trusts in 2020. For example the top federal income tax rate is 37 and the top capital gains tax rate is 20. For tax year 2020 the 20 rate applies to amounts above.

Capital gains and qualified dividends.

Recent Developments In Estate Planning Part 1

Do Irrevocable Trusts Pay The Capital Gains Tax

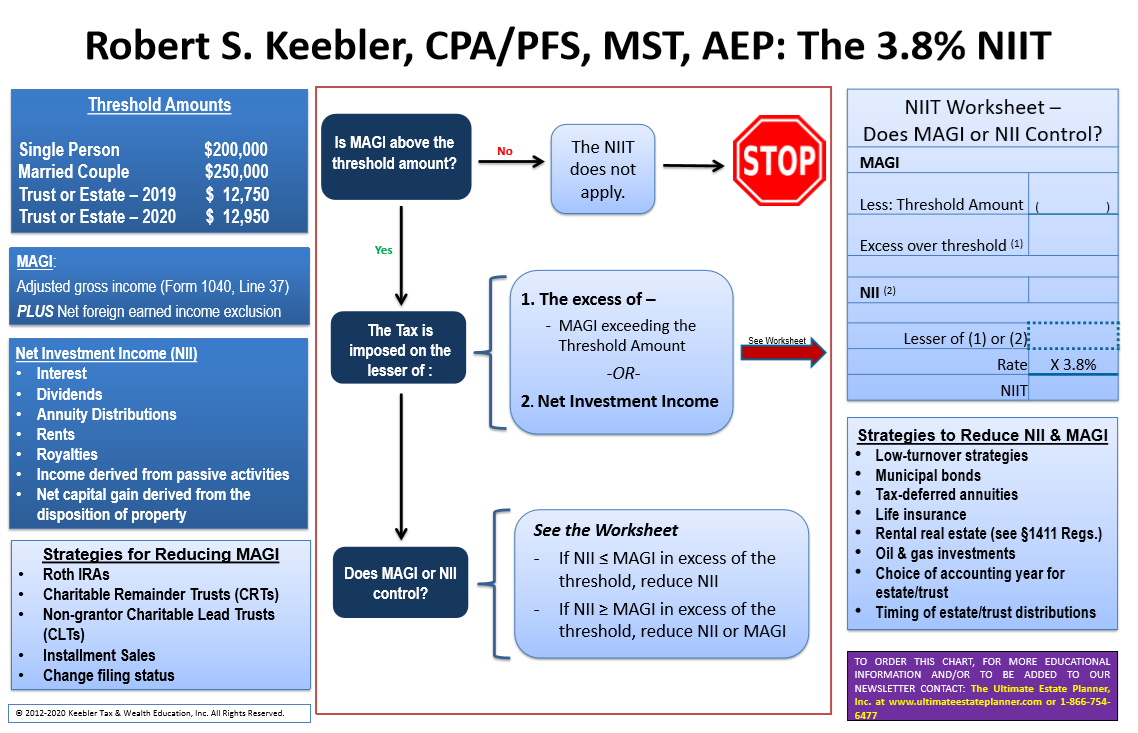

2022 Applying The 3 8 Net Investment Income Tax Chart Ultimate Estate Planner

Proposed Impactful Tax Law Changes And What You Can Do Now Johnson Pope Bokor Ruppel Burns Llp

How To Avoid Estate Taxes With A Trust

Should An Irrevocable Trust Be Part Of My Estate Plan The Lynch Law Group Llc Attorneys In Cranberry Twp And Pittsburgh

Incomplete And Completed Gift Non Grantor Trusts

Is An Irrevocable Trust A Good Idea Lifeplan Legal Az

Capital Gains Taxes And Irrevocable Trusts Burner Law

Estate And Asset Protection Planning In New York An Overview Of Trusts Lorman Education Services

2020 Year End Tax Planning For Trusts Can Yield Major Savings Accounting Today

Generation Skipping Trust Gst What It Is And How It Works

Is An Irrevocable Trust A Good Idea Carrell Blanton Ferris Associates

How Are Capital Gains Taxed Tax Policy Center

Compressed Tax Brackets On Irrevocable Trusts Shannon Law Office Llc

Tax Related Estate Planning Lee Kiefer Park

Estate Planning San Francisco Bay Area Trust Probate And Conservatorship Litigation Lawyer Blog Talbot Law Group P C

Deferring Capital Gains Tax When Selling Art

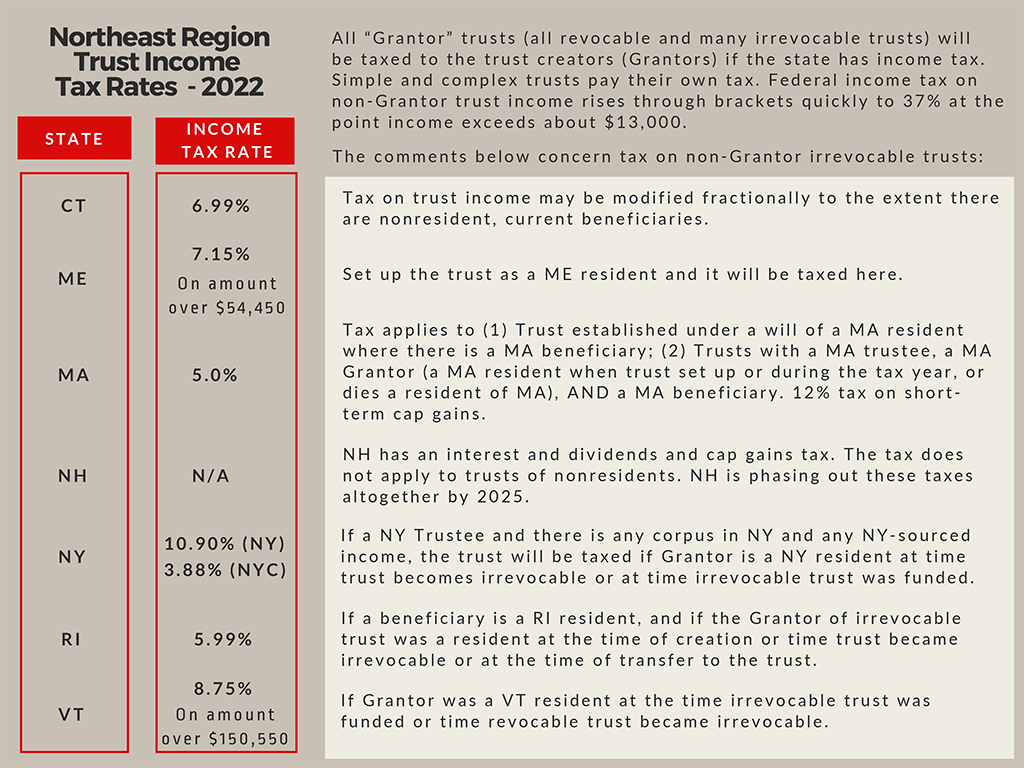

Trust Income Taxes Guide For The Northeast Borchers Trust Law